Trade Secret Applications for Canada

By: Kirsten Alcock, Manager of Product Safety, email

The Hazardous Products Regulations (HPR) dictates what information must be available on a SDS within each prescribed section. The SDS is required by law to disclose all hazardous ingredients within a product formulation, their weight percentage, the applicable CAS number, the toxicological properties such as Threshold Limit Values (TLVs), and any and all precautions that the worker must abide by when handling the product.

If a supplier or manufacturer wishes to withhold the chemical identity and CAS number of any hazardous ingredient(s) on the SDS as Confidential Business Information (CBI), a HMIRA Claim For Exemption Registration must be filed and approved by Health Canada. This is different from the US regulations so please ensure you are preparing your SDSs in accordance with the country you plan to sell your product to. Under a HMIRA Registration, chemical names may be replaced with a Generic Chemical Identity (GCI) and registrants may mask functional groups, location, and number of substitutions. However, broad and vague terms such as “proprietary”, “trade secret”, or “surfactant” are not acceptable.

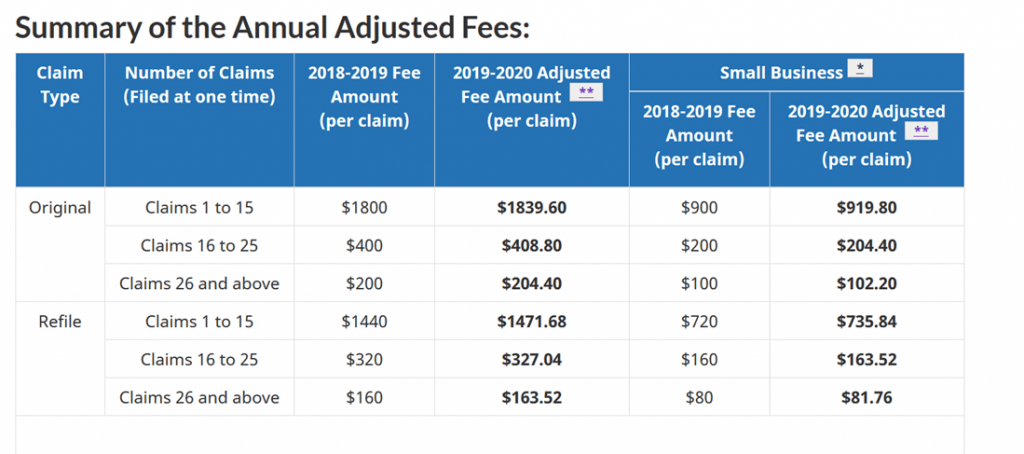

A HMIRA Registry Number is issued by Health Canada and, once granted, it is required to appear on the SDS in order to be sold to the Canadian industrial market. The HMIRA registration must be renewed every three years and a new HMIRA Registry number will be issued. Health Canada requires a full, complete registration package in order to review your claim for exemption. A full submission includes, but is not limited to, the product formula, SDSs associated with your claim, measures taken to protect information, the claim for exemption form, and payment authorization. The fee structure varies depending on whether the submission is an original claim or a refilled claim. When more than 15 claims are filed at the same time, the fees can be reduced. The HMIRA also offers small business fees for smaller companies wishing to claim.

If this is something that interests you and your company, you will want to act quickly. The fees are set to go up April 1st, 2020. Fees associated with HMIRA claims for exemption are subject to an annual fee adjustment in accordance with the Service Fees Act (SFA). Health Canada selected April 1st of every year as the anniversary date for the annual fee adjustments. If you’d like to take advantage of these lower fees, you will need to have all your paperwork in within the next couple of weeks.

HOW DELL TECH CAN HELP:

- Develop Generic Chemical Identity (GCI) for the ingredient(s) you with to claim as CBI

- Prepare and submit a complete registration package to HMIRA on your behalf

- Provide guidance on the payment authorization and fee structure

- Prepare the SDS for the product submission

Contact:

Dell Tech

Kirsten Alcock, B.Sc. (Hons)

Manager, Product Safety Group

519-858-5074

kirsten@delltech.com